Mortgage calculator maximum loan

Income If you calculate based on income the calculator will take information about your financial health and loan preferences combined with projected taxes and insurance to provide an estimate. Financial Strain on the borrower grows over time.

5 Alternative Ways To Use A Mortgage Calculator Zillow

The margin used in our calculator is 175 basis points 175.

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

. Press spacebar to show inputs. Lenders look most favorably on debt-to-income ratios of. It also assumes the additional costs of financing points do not make the loan exceed the maximum.

The loan life is predetermined to ensure maximum profits for the lender. Unsure if you should buy discount points on your mortgage. A mortgage usually includes the following key components.

The maximum loan amount one can borrow normally correlates with. Mortgage type The mortgage type includes the term of the mortgage between 1-10 years and the rate type variable or fixed. This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI.

Not to be confused with the term. The Canadian Mortgage Calculator is mainly intended for Canadian residents and uses the Canadian dollar as currency with interest rate compounded semi-annually. When you put at least 20 down on a conventional loan or 20 home equity on a refinance you can avoid paying monthly private mortgage insurance premiums PMI.

Use this calculator to compare the full cost of a loan with discount points to one without them. Make sure to check their website to know the current loan limits. Thats because FHAs maximum loan-to-value ratio is 965 percent meaning your loan amount cant be more than 965 percent.

Jumbo mortgages are loans that exceed federal loan limits for conforming loan values. These are also the basic components of a mortgage calculator. Conforming limits are adjusted every year by the FHFA.

For 2022 the maximum conforming loan limit for single-family homes in most of the US. The information provided on this website is for general education. Total of 300 Mortgage Payments.

Second mortgages come in two main forms home equity loans and home equity lines of credit. The maximum mortgage calculator will allow you to input your monthly obligations your monthly income to calculate the maximum monthly mortgage payment. Calculation assumes constant interest rate throughout.

Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. The index our calculator uses the Monthly Adjusted LIBOR which is a common index used in the market will adjust regularly as market interest rates move up or down. Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance and HOA fees.

Actual payment amounts may differ and will be determined at the time of signing the Mortgage Loan Agreement. Such demands act as hindrances to potential home owners who are. Forbes Advisors Mortgage Calculator uses home price down payment and other loan details to give you an estimate calculation on your monthly mortgage payments.

Use our calculator to estimate your monthly mortgage payment including principal interest property taxes homeowners insurance and even private mortgage insurance if its required. Your down payment affects the amount you can borrow to buy a home and the size of your payments. The mortgage term is the length of time you commit to the terms conditions and mortgage rate with a specific lender.

This calculator determines your mortgage payment and provides you with a mortgage payment schedule. Conforming loans have maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac. The lender will add a margin to the index to determine the rate of interest actually being charged.

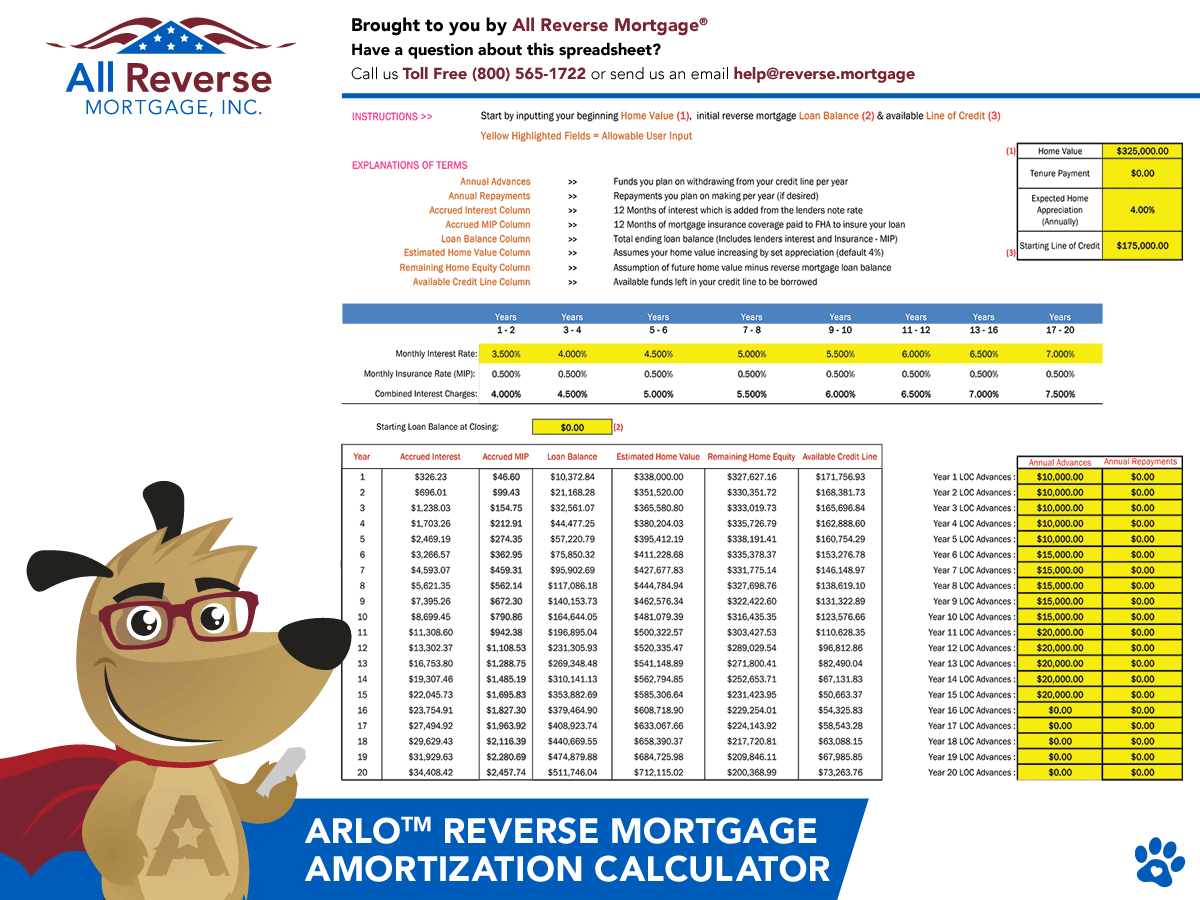

Is 647200 and. This tool is designed to show you how compounding interest can make the outstanding balance of a reverse mortgage rapidly grow over a period of time. The calculator is for residential properties and mortgages.

Additional conditions may apply. You must have at least 5 for a down payment if the home purchase price is less than 500000. Up to 43 typically allowed 36 is ideal FHA loan.

43 typically allowed 50 is possible. The most common amortization period is 25 years. Loan amountthe amount borrowed from a lender or bank.

About home loan specialists. Use this free calculator to help determine your future loan balance. In a mortgage this amounts to the purchase price minus any down payment.

As of 2022 the maximum claim amount for FHA-backed HECMs is 970800 which is 150 of Freddie Macs national conforming. For example if your loan amount is 620000 your mortgage is considered a conforming conventional loan. As of 2022 the maximum conforming limit for single-family homes throughout the US.

A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. Second mortgage types Lump sum. Mortgage Rate Total Interest Cost.

In Australia a contemporary requirement in most scenarios is some collateral or proof of income. The term must be a minimum of 6 months and a maximum of 10 years. Avoid private mortgage insurance.

Mortgage Repayment Calculator Australia. 30-Year Fixed-Rate Mortgage Loan Amount. This will impact your monthly budget.

You will repay this loan. For example a 30-year fixed-rate loan has a term of 30 years. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

The most common mortgage terms are 15 years and 30 years. Adjust the home price loan term down payment and interest rate to find the right mortgage fit for your budget. The number of years over which you will repay this loan.

Home buyers must put at least 35 percent down on an FHA loan. The Loan term is the period of time during which a loan must be repaid. Chases mortgage affordability calculator creates an estimate of what you can afford and what your mortgage payments may be based on either.

The maximum amortization period for mortgages with less than a 20 percent down payment is 25 years. An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan based. Continental baseline is 647200.

Your lenders maximum DTI limit will depend partly on the type of loan you choose.

Mortgage Calculations Using Ba Ii Plus Youtube

Usda Loan Pros And Cons Understanding Mortgages Usda Loan Mortgage

Va Loan Calculator

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

5 Best Mortgage Calculators How Much House Can You Afford

Va Mortgage Calculator Calculate Va Loan Payments

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Online Mortgage Calculator Wolfram Alpha

Home Affordability Calculator For Excel

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Advanced Loan Calculator

Discount Points Calculator How To Calculate Mortgage Points

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Free Reverse Mortgage Amortization Calculator Excel File

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator